41 sales tax discount math worksheets

California (CA) Sales Tax Rates by City - Sale-tax.com With local taxes, the total sales tax rate is between 7.250% and 10.750%. California has recent rate changes (Thu Jul 01 2021). Select the California city from the list of popular cities below to see its current sales tax rate. › money-consumer-mathMoney And Consumer Math Worksheets pdf | Math Champions Free printable math worksheets on expenses calculation are presented on this consumer math worksheet page. This is where kids will learn how to calculate to rationality of the value of money. The first rule to stay rational in spending money should be tightly connected to attributing the right value to what we are spending a certain amount of ...

Money And Consumer Math Worksheets pdf | Math Champions Free printable math worksheets on expenses calculation are presented on this consumer math worksheet page. This is where kids will learn how to calculate to rationality of the value of money. The first rule to stay rational in spending money should be tightly connected to attributing the right value to what we are spending a certain amount of ...

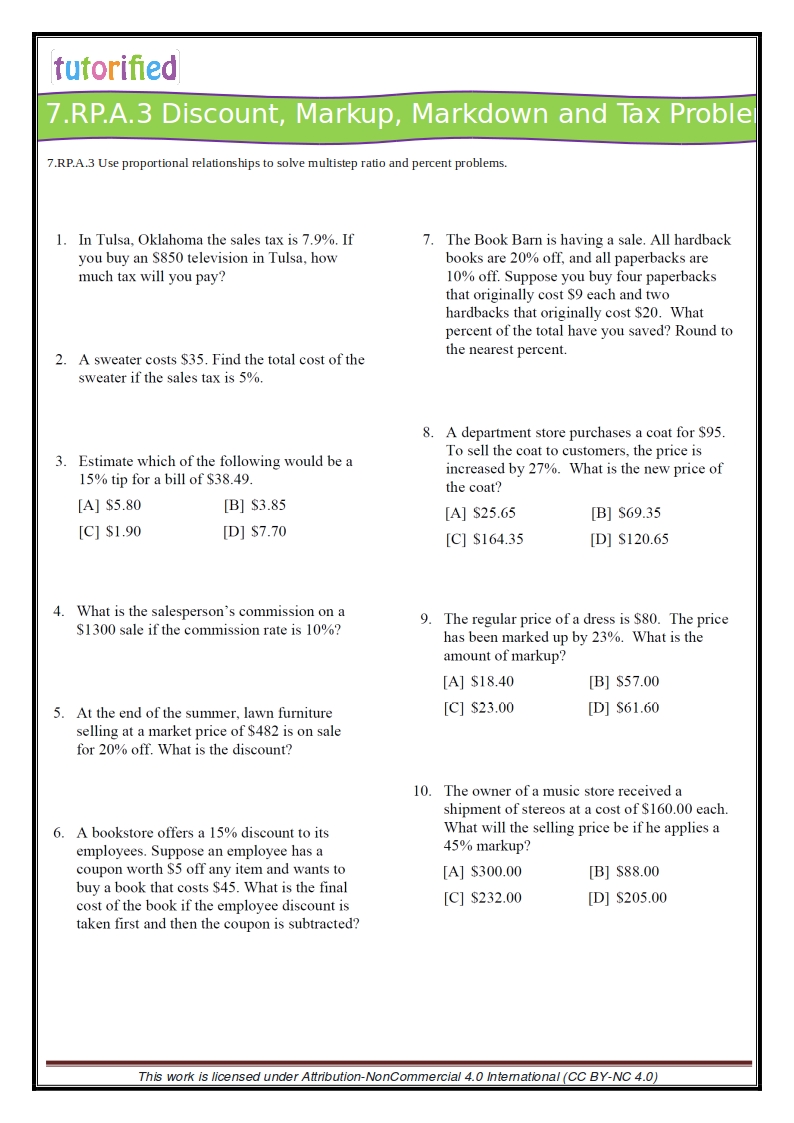

Sales tax discount math worksheets

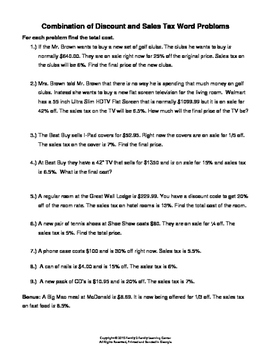

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets. Sales Tax Discount Worksheets & Teaching Resources | TpT The problems cover sales tax, discount, and tip and several problems include more than one step. ... Markups, Sales Tax and Tip in their math class. Step by step instructors are included on the example slides with two additional problems given after to check for understanding. ... These come in 4 different formats: Google forms, worksheet, task ... eupolcopps.euThe EU Mission for the Support of Palestinian Police and Rule ... Oct 14, 2022 · Tokyo Street 15, Abraj Building, 3rd Floor, Ramallah, oPt. P.O. Box, 935, Jerusalem, 91010. TEL: +972 (0) 2 297 6677 FAX: +972 (0) 2 297 6676

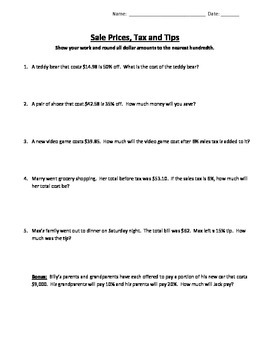

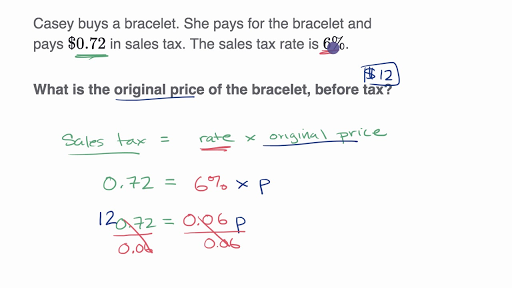

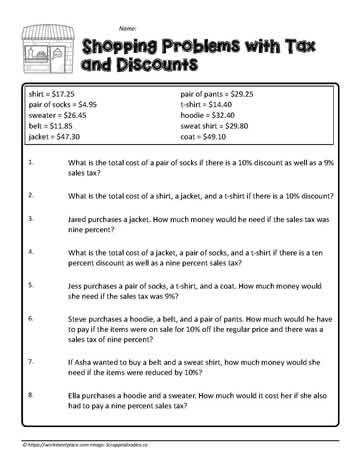

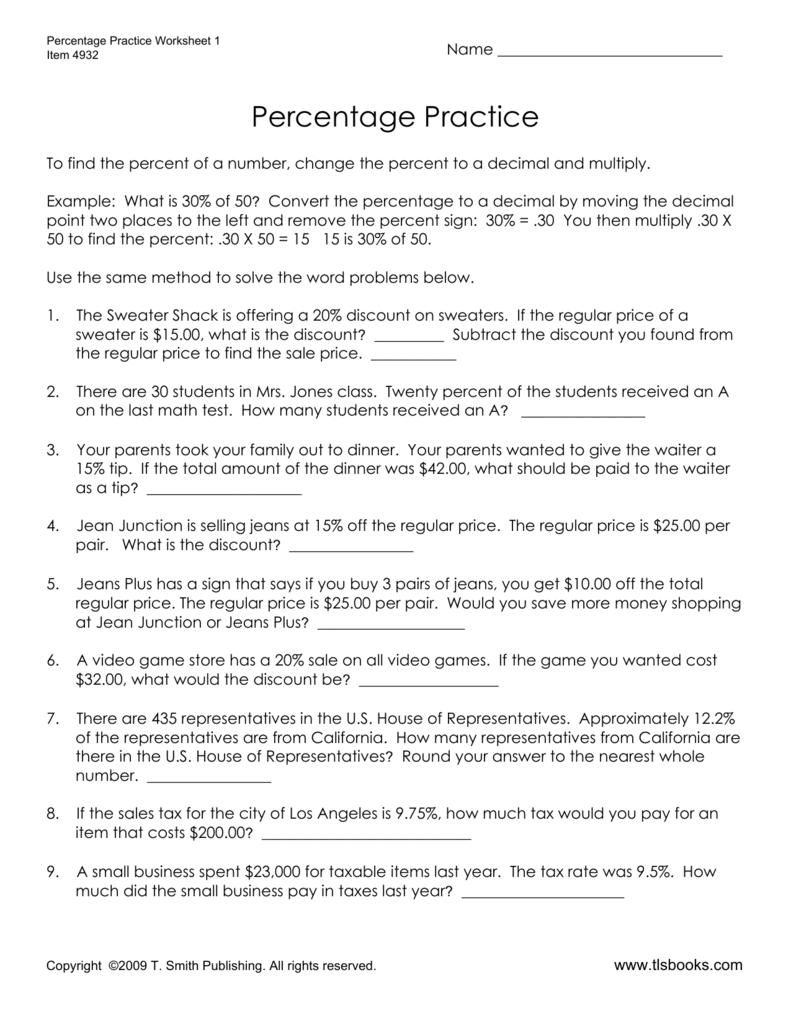

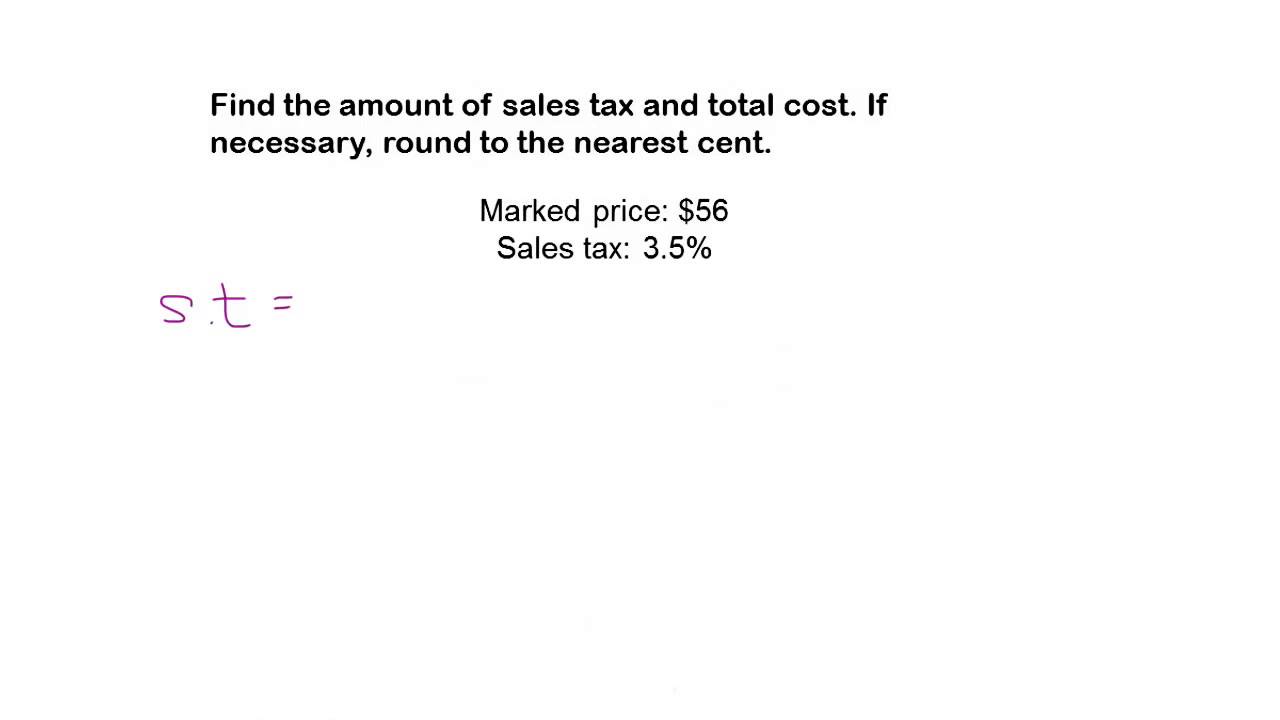

Sales tax discount math worksheets. PDF Sales Tax and Discount Worksheet - psd202.org Discount, Tax, and Tip Worksheet Name: _____ Discount: The amount saved and subtracted from the original price of an item to get the discounted price. Procedure: 1. The rate is usually given as a percent. ... If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) WORKSHEET ON DISCOUNT AND SALES TAX - onlinemath4all Solution : Selling price after first discount = 80% of 18500. = 0.80 (18500) = 14800. Selling price after the 2nd discount = 95% of 14800. = 0.95 (14800) = $14060. So, the selling price after the second discount is $14600. Apart from the stuff given above, if you need any other stuff in math, please use our google custom search here. Sales Tax Worksheets - Math Worksheets 4 Kids There's nothing too taxing about our printable sales tax worksheets! Teeming with exercises like finding the sales tax, calculating the original price, and solving sales tax word problems, our resources have stupendous practice in store for students in grade 6, grade 7, and grade 8. › sales-taxSales Tax Worksheets - Math Worksheets 4 Kids Help them excel in sales tax using our free worksheets and prepare to face the world head-on! Finding Sales Tax When you buy an item that is taxed, not only do you pay the cost of the item, you also pay the sales tax. Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price

Fremont, California Sales Tax Rate (2022) - Avalara What is the sales tax rate in Fremont, California? The minimum combined 2022 sales tax rate for Fremont, California is 10.25%. This is the total of state, county and city sales tax rates. The California sales tax rate is currently 6%. The County sales tax rate is 0.25%. The Fremont sales tax rate is 0%. Did South Dakota v. Sales Tax And Discount Worksheets - K12 Workbook 1. Sales Tax and Discount Worksheet 2. Sales Tax and Discount Worksheet - 3. Sales Tax Practice Worksheet 4. Discount, Tax and Tip 5. Discount, Markup, and Sales Tax 6. How to calculate Discount and Sales Tax How much does that ... 7. Taxes, Tips, and Sales 8. percent word problems (tax, tip, discount) Discount & sales tax worksheet - Liveworksheets.com Discount & sales tax worksheet. Live worksheets > English. Discount & sales tax. Students will be given a scenario and then asked to calculate the discount, sale price, tax and total cost. ID: 3005084. Language: English. › lessons › percentHow To Calculate Discount and Sale Price - Math Goodies Typically, a store will discount an item by a percent of the original price. The rate of discount is usually given as a percent, but may also be given as a fraction. The phrases used for discounted items include, " off," "Save 50%," and "Get a 20% discount." Procedure: To calculate the discount, multiply the rate by the original price.

Discount Sales Tax Worksheets Teaching Resources | TpT Sales Tax, Tip, and Discount Color-By-Number Worksheet by Eugenia's Learning Tools 4.7 (15) $3.00 PDF This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. corner.bigblueinteractive.com › indexThe Corner Forum - New York Giants Fans Discussion Board ... Big Blue Interactive's Corner Forum is one of the premiere New York Giants fan-run message boards. Join the discussion about your favorite team! The EU Mission for the Support of Palestinian Police and Rule of Law Oct 14, 2022 · EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6 In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper?

tip and tax worksheet answer key tax sales worksheet discounts tip worksheets lesson plans grade homework 5th 9th tips planet reviewer rating. ... Percent problems word answers math worksheets worksheet mr quiz tax percentage discount tip answer problem grade key algebra simple tips. Tax problems word tip discount percent grade math. Discount, markeup, tax, tip-percent word ...

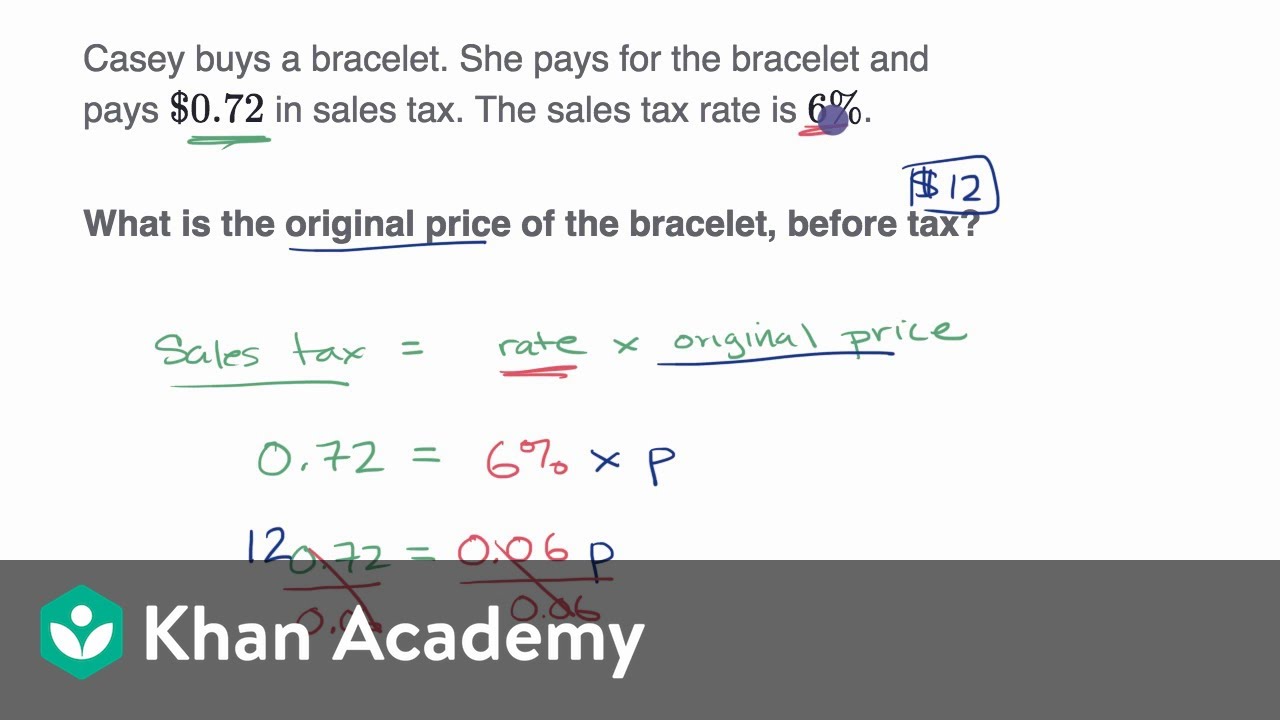

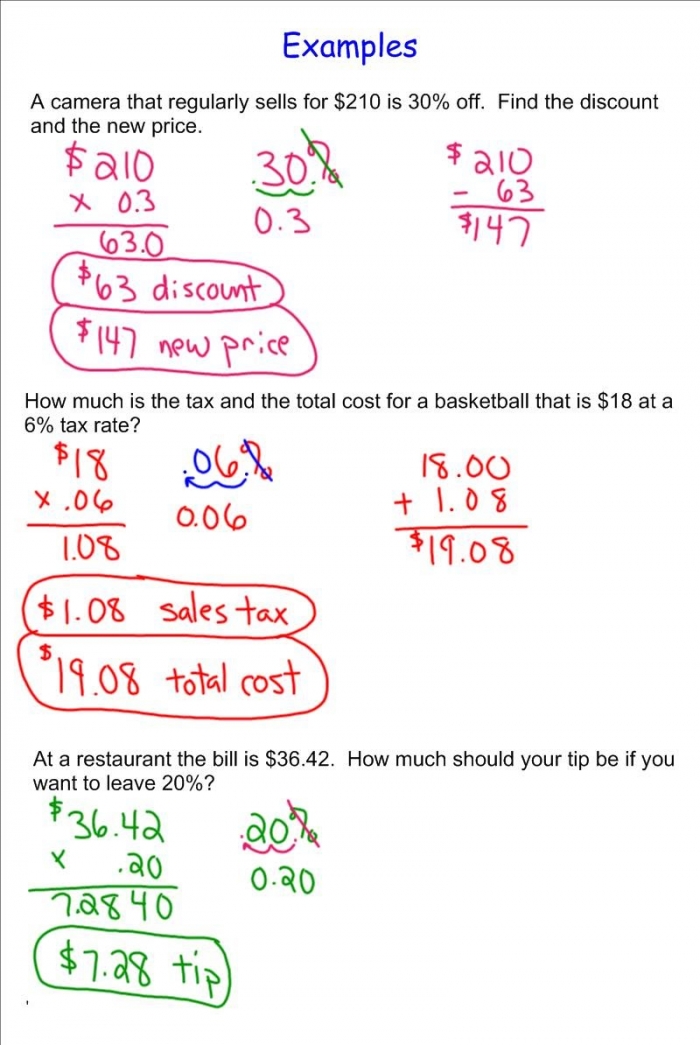

SALES TAX DISCOUNT AND TIP WORKSHEET - onlinemath4all Estimate the tax on shoes that cost $68.50 when the sales tax rate is 8.25%. Problem 3 : The dinner check for Mr. David's family is $70. If a tip of 15% is paid, How much total money should Mr. David pay ? Problem 4 : If the sales tax rate is 6%, find price of the shirt after sales tax on a shirt that costs $30. Problem 5 :

Taxes Discount And Commission Percents Worksheets - K12 Workbook Taxes Discount And Commission Percents. Displaying all worksheets related to - Taxes Discount And Commission Percents. Worksheets are Discount tax and tip, Taxes tips and sales, Percent word problems tax tip discount, Percent word problems tax tip discount, Percent word problems tax tip discount, Percent word problems tax tip discount, Percent ...

› oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · Tax Examiners and Collectors, and Revenue Agents: ... Math and Computer Science Teachers, Postsecondary ... Sales Representatives, Wholesale and Manufacturing:

Markup and Markdown Problems - Online Math Learning b. Find the discount rate. c. By law, sales tax has to be applied to the discount price. However, would it be better for the consumer if the 7.5% sales tax were calculated before the discount was applied? Why or why not? d. Write an equation applying the commutative property to support your answer to part (c). Show Video Lesson

The Corner Forum - New York Giants Fans ... - Big Blue Interactive NFT: Stranger Things question: Matt M. 1:06 am 71: 0: Matt M. 1:06 am NFT: ALDS Game 3 - New York Yankees @ Cleveland Guardians - 7:37p: arcarsenal 10/15/2022 4:35 pm : 3954: 282: Matt M. 2:09 am NFT: Former CEO downplays the importance of a college degree

California Vehicle Sales Tax & Fees [+Calculator] - Find The Best Car Price The minimum is 7.25%. Multiply the vehicle price (before trade-in or incentives) by the sales tax fee. For example, imagine you are purchasing a vehicle for $20,000 with the state sales tax of 7.25%. $20,000 X .0725 = $1,450. $1,450 is how much you would need to pay in sales tax for the vehicle, regardless of if it was used, purchased with ...

byjus.com › ncert-solutions-class-8-maths › chapterNCERT Solutions for Class 8 Maths Chapter 8 Comparing Quantities Discount = Discount % of the Marked Price; Additional expenses made after buying an article are included in the cost price and are known as overhead expenses. CP = Buying price + Overhead expenses; Sales tax is charged on the sale of an item by the government and is added to the Bill Amount. Sales tax = Tax% of Bill Amount.

math tax worksheet Tax Problems: Worksheet Sales Tax Problems. 15 Pictures about Tax Problems: Worksheet Sales Tax Problems : Sales Tax Worksheet 7th Grade Percent Increase Discount Tax Tip Lessons, Taxation Worksheet Answers | db-excel.com and also Maths Consumer Arithmetic Wages Salaries Worksheet Worksheet : Resume.

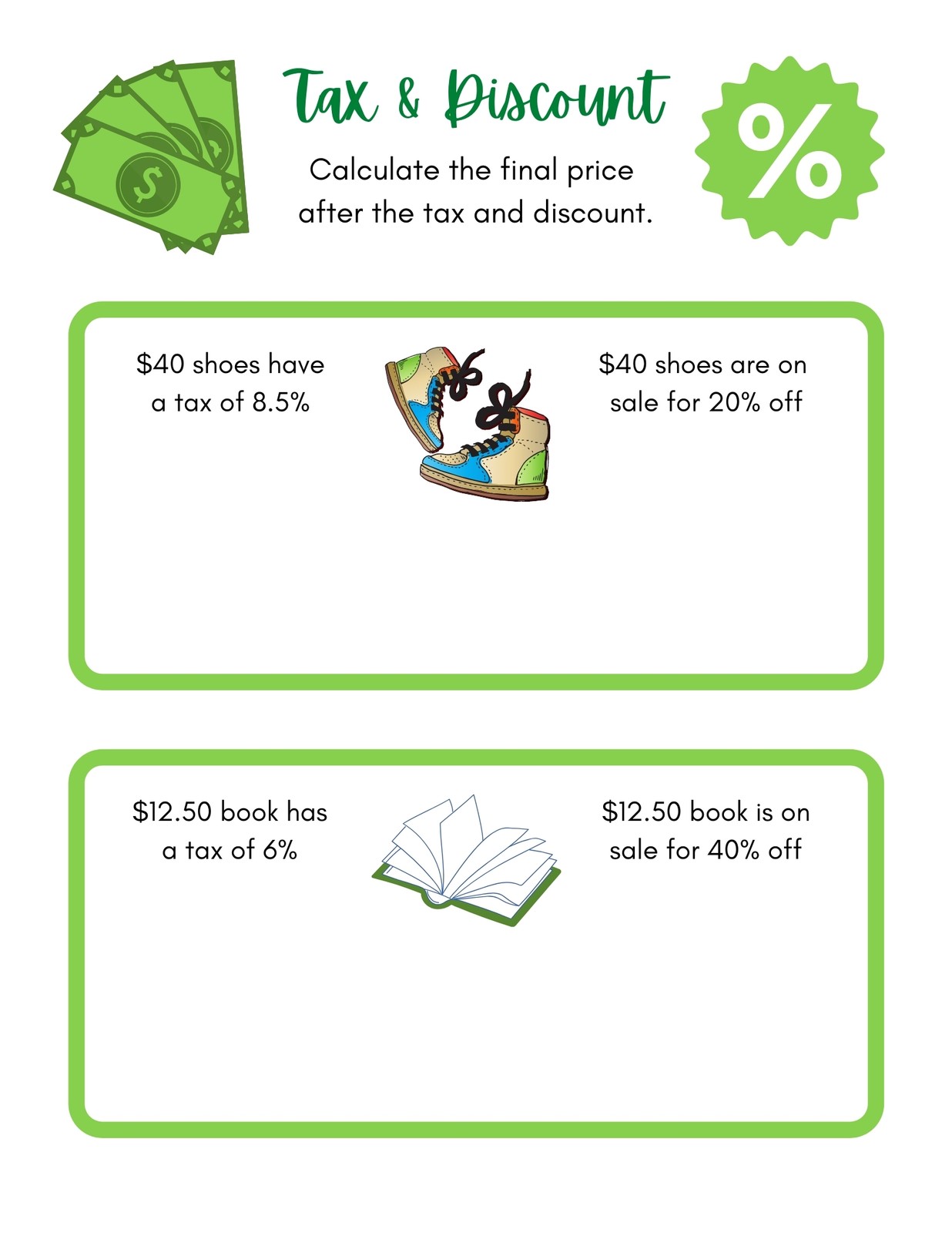

Applying Taxes and Discounts - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount ... Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied.

tip and tax worksheet 32 Sales Tax Math Problems Worksheet - Support Worksheet martindxmguide.blogspot.com. percents promotiontablecovers 99worksheets. Realtor Tax Deductions And Tips You Must Know . ... Tax worksheet sales discount percent finding worksheets worksheeto shopping via. Percent discount, taxes and tips coloring worksheet.

History of Statewide Sales and Use Tax Rates - California 3.00%. 3.00%. 8/01/33. 6/30/35. 2.50%. 2.50%. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in 1955. The law authorizes counties to impose a sales and use tax. Effective January 1, 1962, all counties have adopted ordinances for the California Department of Tax and Fee Administration formerly the Board of Equalization to ...

Consumer Math, Spending Money, Worksheets, Lesson Plans, … Consumer Math Lesson Plans Spending Lessons Educational Exercises Worksheets Classroom Teaching Theme Unit Teacher Resources Assessment Formulas Quizzes Activity Free Tutorial Curriculum Basics. ... Teach your students the concept of a discount, while reinforcing basic math skills.` Learn to be a good consumer. ... SALES TAX - PAYING TAXES ...

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

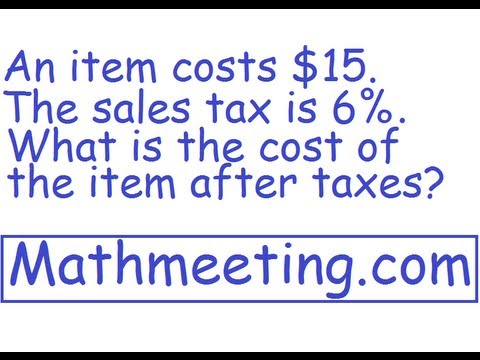

Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Analysis: Sales tax is the difference between the amount of the total bill and the price of the item. If we divide the sales tax by the price of the item, we get the sales tax rate. Solution: $17.68 - $17.00 = $0.68 and ($0.68) ÷ ($17.00) = 0.04. Answer: The sales tax rate is 4%. Summary: Sales tax is a tax on goods and services purchased and ...

NCERT Solutions for Class 8 Maths Chapter 8 Comparing Quantities … Discount = Discount % of the Marked Price; Additional expenses made after buying an article are included in the cost price and are known as overhead expenses. CP = Buying price + Overhead expenses; Sales tax is charged on the sale of an item by the government and is added to the Bill Amount. Sales tax = Tax% of Bill Amount.

Taxation in India - Direct taxes & Indirect Taxes, Features of Sales tax is levied by either the Central or the State Government, Central Sales tax, or 4% is generally levied on all inter-State sales. State sales taxes that apply to sales made within a State have rates that range from 4 to 15%. However, exports and services are exempt from sales tax. Service tax. Service tax is a part of Central Excise in ...

Percent Of A Number Tax Discount And More Eighth Grade Math Worksheets Sales Tax Worksheets Math Worksheets 4 Kids. 9 hours ago There's nothing too taxing about our printable sales tax worksheets!Teeming with exercises like finding the sales tax, calculating the original price, and solving sales tax word problems, our …. Preview / Show more . See Also: Work Show details

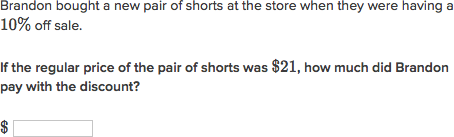

How To Calculate Discount and Sale Price - Math Goodies Typically, a store will discount an item by a percent of the original price. The rate of discount is usually given as a percent, but may also be given as a fraction. The phrases used for discounted items include, " off," "Save 50%," and "Get a 20% discount." Procedure: To calculate the discount, multiply the rate by the original price.

eupolcopps.euThe EU Mission for the Support of Palestinian Police and Rule ... Oct 14, 2022 · Tokyo Street 15, Abraj Building, 3rd Floor, Ramallah, oPt. P.O. Box, 935, Jerusalem, 91010. TEL: +972 (0) 2 297 6677 FAX: +972 (0) 2 297 6676

Sales Tax Discount Worksheets & Teaching Resources | TpT The problems cover sales tax, discount, and tip and several problems include more than one step. ... Markups, Sales Tax and Tip in their math class. Step by step instructors are included on the example slides with two additional problems given after to check for understanding. ... These come in 4 different formats: Google forms, worksheet, task ...

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets.

:max_bytes(150000):strip_icc()/Christmas-Shopping-Worksheet-3-56a602eb5f9b58b7d0df784d.jpg)

0 Response to "41 sales tax discount math worksheets"

Post a Comment